Gain valuable insights

about your energy requirements

with our experts.

SCHEDULE A MEETING

Leading the Way in Sustainable Innovation with Cutting-Edge Solar Solutions

Discover the different financial models available for solar investments through our detailed videos. From CAPEX to OPEX, and Deferred CAPEX models we provide insights into each approach to help you choose the best fit for your needs. Watch the videos to learn more.

INQUIRE NOW

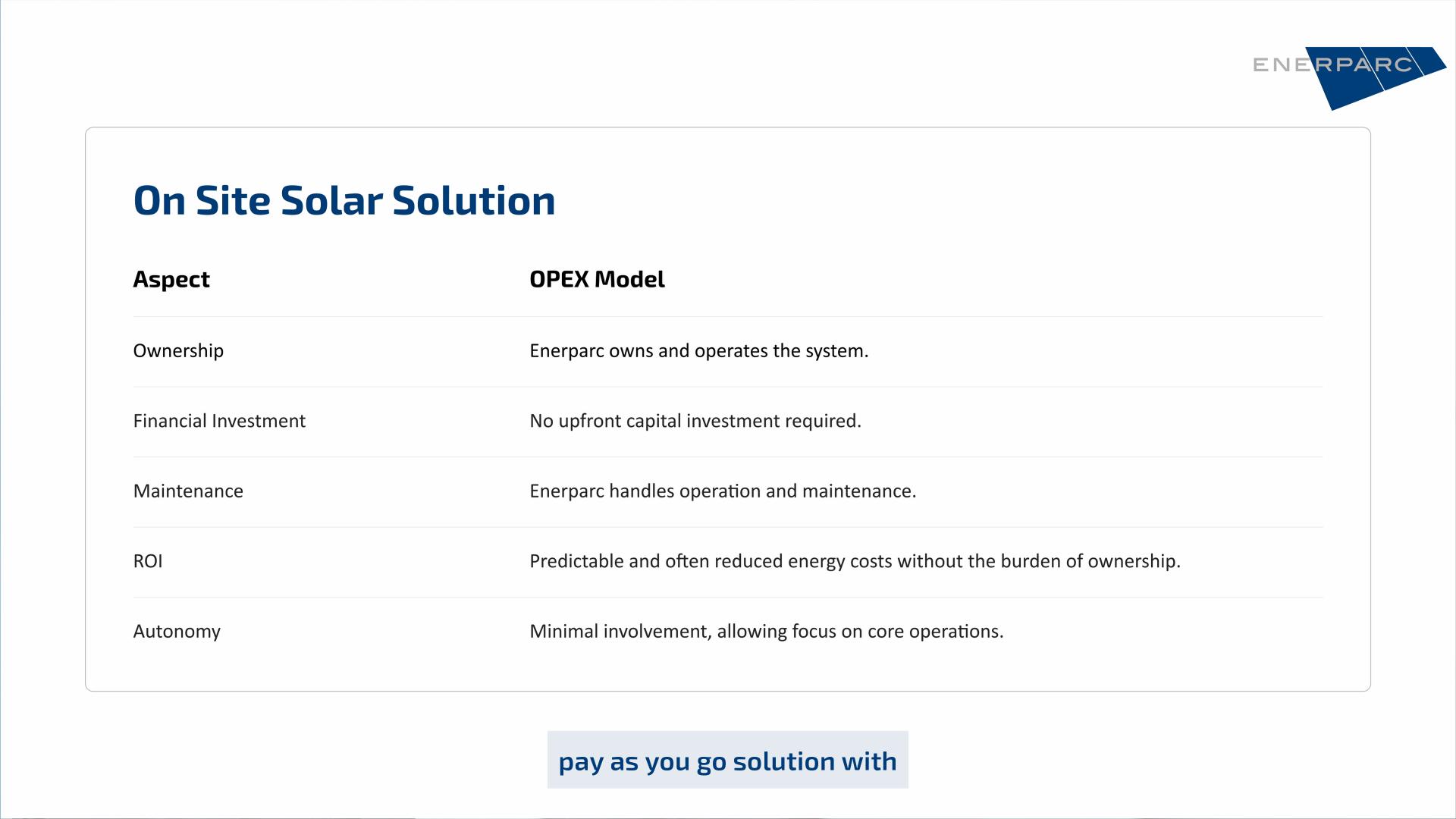

OPEX involves no upfront investment, utilizing a pay-as-you-go PPA model that offers flexibility with ongoing payments. In contrast, CAPEX requires a significant initial investment but delivers a higher ROI. Compare both models to determine which aligns best with your financial strategy and long-term goals.

| OPEX Model |

CAPEX Model |

|

|---|---|---|

| Enerparc owns the asset | OWNERSHIP | Customer owns the asset |

| Zero upfront investment by the customer | INVESTMENT | 100% investment accountability lies with the customer |

| Pay only for electricity generated | WHAT YOU PAY FOR | Pay only for O&M charges after system purchase; no tariff for solar electricity generated |

| 20-40% cheaper than grid electricity tariff | PER UNIT SAVING | Capital is repaid through generated electricity |

| Turnkey solution; Enerparc bears O&M costs | O&M | The customer bears the O&M cost |

| Savings from day one (zero days) | PAYBACK | Payback as high as 4 years |

| Enerparc bears all performance risks and is incentivized to maximize generation because revenues are linked entirely to generation | PERFORMANCE RISK | The customer bears all performance risks and must manage equipment and downtime losses |

| No tax benefits for the customer | TAX BENEFITS | Customers can claim tax benefits through accelerated depreciation |

| Enerparc’s prerogative | REGULATORY RISK AND APPROVALS | Owner's prerogative |

As onsite solar reduces carbon emissions and dependency on fossil fuels, it offers financial savings, energy independence, and environmental advantages.

The space required depends on the energy needs of the facility and the efficiency of the solar panels. Rooftop installations usually require unobstructed, flat or slightly sloped surfaces with minimal shading.

The payback period, which varies according to system size, location, and incentives, usually lasts between three and seven years after which the energy produced is almost free.

It is possible to combine onsite solar systems with battery storage to get advantages including energy independence, backup power during blackouts, and improved energy management during periods of high demand.

Site evaluation, system design, obtaining licenses, installation, and commissioning are usually steps in the process. Each step requires coordination with local authorities and utility companies.

Although they work best in sunny weather, solar systems may still provide electricity on overcast days. The amount of energy produced overall is impacted by seasonal variations in the sun's angle and the length of daylight.

Tax credits, rebates, accelerated depreciation, and net metering rules are a few examples of incentives that can lower upfront costs and increase return on investment.

Regular panel cleaning, recurring inspections, system performance monitoring, and verifying that inverters and other components are operating as intended are all standard components of maintenance.